The termination of an agreement between the Ministry of Health and Family with Indian company Apollo Hospitals Enterprises to manage and develop the Indira Gandhi Memorial Hospital (IGMH) cost the government US$150,000, the Ministry of Finance and Treasury’s audit report for 2010 has revealed.

The audit report (Dhivehi) made public on Thursday (June 6) flagged an advance payment of US$ 150,000 from the finance ministry’s special budget to Apollo Hospitals as 20 percent of a transition management fee under the “management and development agreement” (MDA) signed on January 23, 2010.

Auditor General Niyaz Ibrahim contended that the payment was made by the finance ministry in violation of budgetary rules and accounting principles, adding that expenses of another office or institution should not be included in the finance ministry’s financial statement.

Moreover, the privatisation of the government hospital was not overseen by the privatisation committee as stipulated in public finance regulations amended in late 2009, the audit report noted.

The secretariat of the privatisation committee, which functioned under the Ministry of Economic Development, informed auditors that interested parties were invited to submit detailed proposals for developing IGMH in a public-private partnership deal in January 2009.

However, none of the detailed bids met the criteria set by the health ministry and the privatisation project was scrapped.

Following a visit by then-President Mohamed Nasheed to India, Health Minister Dr Aminath Jameel told the press on January 25, 2010 that Apollo was awarded the project because none of the bidders fit the criteria.

Apollo was chosen following consultation with the Indian government and based on legal advice, she added.

However, in August 2010, the Male’ Health Services Corporation – which operated IGMH – advised the health ministry against proceeding with the privatisation deal as Apollo’s proposal was not financially feasible for the government-owned health corporation.

On September 30, 2010, the health ministry informed Apollo that the government has decided to scrap the project since the necessary financial capital had not been arranged.

The audit report also noted that a transition management agreement and an operation management agreement that was required under the MDA was not signed in the stipulated 180-day period.

“Therefore, the US$ 150,000 paid to Apollo Hospitals under the MoU [Memorandum of Understanding] signed with IGMH in 2010 was a waste of funds with no benefit to the state,” the audit report stated.

It added that the loss was incurred as a result of “inadequate planning” before hastily signing the MoU without obtaining legal advice, considering the financial burden on the state and determining a source of capital.

The Auditor General recommended asking the Anti-Corruption Commission (ACC) to determine whether any state official abused their authority in awarding the project to Apollo Hospitals without a bidding process.

Other cases

Among eight other cases highlighted in the report where expenses were made ostensibly in violation of public finance law, the audit revealed that in 2007 the government incurred a loss of MVR 30.8 million (US$1.9 million) after paying for 150,000 copies of the Quran Dhivehi translation with numerous errors.

The audit report noted that the project was awarded to Novelty Printers without a bidding process through the tender evaluation board.

Moreover, an advance payment of 85 percent of the contracted amount was made to Novelty Printers in violation of existing regulations, the audit discovered.

In June 2010, the Fiqh Academy decided to destroy the copies printed in 2007 as the errors could not be easily corrected. The decision was made following a year-long review by scholars of the academy.

The audit discovered that the errors in the final version were not present in the proofed copy approved by the President’s Office in 2007 – during the final years of former President Maumoon Abdul Gayoom’s reign – suggesting that Novelty was responsible for the errors.

Novelty Printers wrote to the President’s Office in November 2008 apologising for the printing errors, which they explained occurred due to a problem in the computer file used to make the printing plates.

The audit also discovered that Novelty was paid the remaining 15 percent of the contracted amount in May 2010 after a state minister at the finance ministry approved the payment.

The state minister sent a memo to the budget section falsely claiming that the government had received all 150,000 copies, the audit report noted.

The Auditor General recommended that the ACC should investigate the culpable official for alleged corruption and that the state should either recover the MVR 30 million paid to Novelty or demand 150,000 copies without errors.

The audit report also noted that the government was ordered by the Civil Court in January 2010 to pay US$119,616 as compensation for a former deputy general manager of the Maldives National Shipping Line (MNSL) for unlawful termination in 2002.

The Auditor General recommended legal action against the government officials responsible for incurring the financial loss by unlawfully sacking the MNSL deputy manager in 2002.

The audit further revealed that in 2009 and 2010 the finance ministry paid US$ 4 million to two American companies under a “settlement agreement” while arbitration proceedings were ongoing in Singapore.

In 2006, a consortium formed by the International Medical Group and Sirius International Insurance Corporation was awarded a contract to provide health insurance for government employees.

The companies sought arbitration in Singapore following a contract dispute with the now-defunct Ministry of Higher Education, Employment and Social Security. However, the US$4 million settlement was reached out of arbitration in May 2009 by the new government that took office in November 2008.

The settlement was paid out of the finance ministry’s special budget in 2009 and 2010.

The Auditor General recommended “a thorough investigation” to recover the financial loss incurred by the government as a result of the contract.

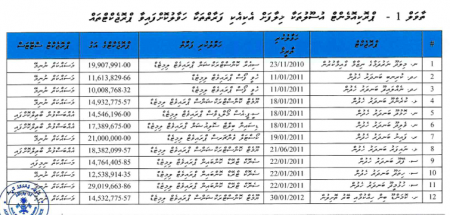

The audit report also contended that the finance ministry had not undertaken “adequate efforts” to recover MVR 51.4 million (US$3.3 million) owed to the government as loan repayments as of December 2010.

The loans worth a total of MVR 69.4 million (US$4.5 million) were provided to select individuals by the President’s Office from 1992 to 2006 under special privileges afforded to then-President Gayoom.

The loans were given with a six percent interest rate to be paid back within two to five years, the report found, noting that the repayment period would have lapsed in 2011 for the most recent loans.

However, in a letter sent to the finance ministry on November 6, 2008 – five days before Gayoom left office – the repayment period was extended to five years.

As the loans were given to senior officials of the outgoing government, the audit report contended that the decision to extend the repayment period amounted to corruption.

The Auditor General therefore asked for an investigation by the ACC into the extension and recommended that the finance ministry file court cases to recover the unpaid amounts.

Likes (0)Dislikes

(0)Dislikes (0)

(0)

(1)Dislikes

(1)Dislikes (0)

(0)