Economic growth in the Maldives is expected to remain “relatively strong in the near term,” but persistent fiscal deficits have driven up the public debt ratio to a high level, the International Monetary Fund (IMF) has said.

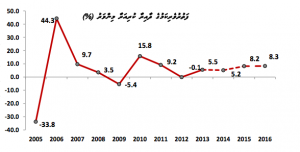

In a press statement last week following its executive board’s 2014 Article IV consultation with the Maldives, the IMF noted that growth is estimated to have reached five percent last year on the back of strong tourism activity, low inflation levels, and reduction in the current account deficit.

“However, persistent and growing fiscal deficits have driven up the public debt ratio to a high level,” the IMF observed.

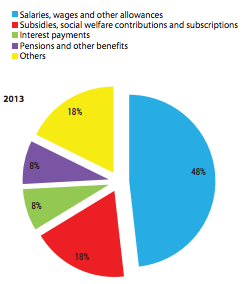

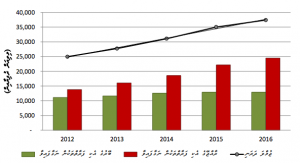

“The fiscal deficit increased to an estimated 7.8 percent of GDP in 2013 and, following increases in recurrent spending, the deficit is likely to have widened further in 2014. Sustained primary deficits have led to an increase in the public debt level from 52 percent in 2009 to 75 percent of GDP in 2014.”

However, presenting the 2015 state budget to parliament in November, Finance Minister Abdulla Jihad said public debt was expected to reach MVR31 billion (US$2 billion) or 67 percent of GDP at the end of 2014.

Moreover, Jihad said the estimate for economic growth in 2014 was 8.5 percent, significantly higher than the IMF estimate.

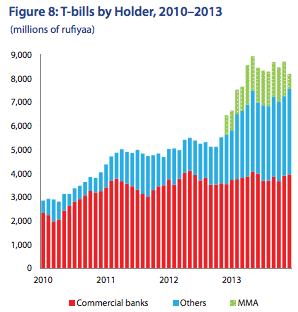

In its monthly economic review for January, the Maldives Monetary Authority (MMA) revealed that the “total outstanding stock of government securities, which includes Treasury bills (T-bills) and Treasury bonds (T-bonds), rose by 53 percent in annual terms and reached MVR17.6 billion [US$1.1 billion] at the end of January 2015.”

“The annual increase in T-bonds reflects the conversion of a short term loan extended to the government by the MMA to T-bonds,” the central bank explained.

While the government’s forecast for economic growth in 2015 was 10.5 percent, the IMF expects growth to be around 5 percent this year.

Growth in 2014 was driven by “a rapid expansion from Asian markets and a tepid recovery from Europe,” the IMF noted.

“Higher tourism exports and subdued global food and fuel inflation have helped reduce the current account deficit to around 8.4 percent of GDP in 2014; and following significant data revisions, the current account is now substantially smaller than previously estimated. Lower oil prices have improved the outlook for the current account and inflation in 2015,” the IMF explained.

“Gross official reserves have risen to around $614 mn (2.8 months imports). Financial soundness indicators are slowly improving, monetary conditions are loose, but credit growth is subdued at just 0.5 percent year on year to November 2014.”

Reining in the fiscal deficit

The IMF welcomed the government’s cost-cutting and revenue raising measures for 2015 – intended to rein in the fiscal deficit -including imposing a green tax, acquiring fees from Special Economic Zones (SEZs), raising import duties, a public employment freeze, and better targeting of subsidies.

“However, further fiscal adjustment measures would be needed to place debt ratios firmly on a downward path,” the IMF cautioned.

Moreover, the IMF noted that “the fiscal adjustment envisaged in the 2015 budget will have a mildly negative effect on growth.”

“There is also some upside potential if lower oil prices are sustained. However, with limited policy buffers, the economy is vulnerable to fiscal slippages and inward spillovers. In the event of large fiscal overruns relative to the authorities’ targets, borrowing costs and monetization could increase, which would weaken the external position,” the press release stated.

In addition to the proposed revenue raising – which it suggested would “only have a temporary effect” – the IMF advised that “durable fiscal adjustment, with a focus on expenditure restraint, will be needed to place the public debt-to-GDP ratio on a downward path over the medium term, consistent with the Fiscal Responsibility Law.”

The IMF executive board also welcomed “the authorities’ commitment to avoiding the monetization of the fiscal deficit, which will help direct monetary policy at supporting the exchange rate regime and build buffers.”

The directors “supported plans to make greater use of market-based financing for government debt, including by developing the government securities market” and welcomed “the improvement in financial soundness indicators, and called for continued efforts to strengthen financial supervision, including measures to ensure uniform high standards for institutions that decide to operate in special economic zones.”

The IMF also suggested the stabilised exchange rate regime was “appropriate for Maldives,” welcomed “the increase in official reserves, and recommended continued strengthening of the official reserves position.”

On key medium-term objectives, the IMF recommended public service delivery and economic diversification and welcomed “proposals for establishing regional hubs and improving inter-island connectivity.”

“Directors stressed that strict ring-fencing of tax exemptions for special economic zones will be necessary to preserve the tax base. They also emphasized that scaling up infrastructure investment should be implemented efficiently in order to boost growth potential,” the press release stated in conclusion.

“Directors welcomed the significant recent improvements in macroeconomic statistics, and encouraged the authorities to continue to strengthen data quality and availability, including adopting a statistics law to enhance data provision, to assist policy decisions.”

Related to this story

Maldives economy “relatively buoyant” but fiscal imbalances continue to growth: IMF

Public debt to reach MVR31 billion by end of 2014, reveals finance minister

Finance minister presents record MVR24.3 billion state budget to parliament

Slippages in revenue or expenditure will undermine debt sustainability: MMA macroeconomic report

IMF delegation surprised by resilience of Maldivian economy

(0)Dislikes

(0)Dislikes (0)

(0)