The state budget for 2013 submitted to parliament by Finance Minister Abdulla Jihad has come under heavy criticism from both opposition and government-aligned parties during last week’s 16-hour budget debate.

Speaking during Thursday’s sitting, Majority Leader MP Ibrahim Mohamed Solih ‘Ibu’, parliamentary group leader of the formerly ruling Maldivian Democratic Party (MDP), contended that the proposed budget could not be salvaged or improved through amendments.

Ibu suggested that parliament should “set this aside” and approve enough funds for the state to function in the first three months of 2013.

“After that, appeal [to the government] to propose a budget that is beneficial to the whole nation and represents all constituencies. I don’t believe we can implement this budget any other way,” the majority leader said.

Ibu argued that the estimated revenue of MVR 12.9 billion (US$836 million) was unlikely to materialise.

“This [projected income] includes MVR 1.8 billion (US$116 million) in new revenue. [But] this will not be received,” Ibu asserted.

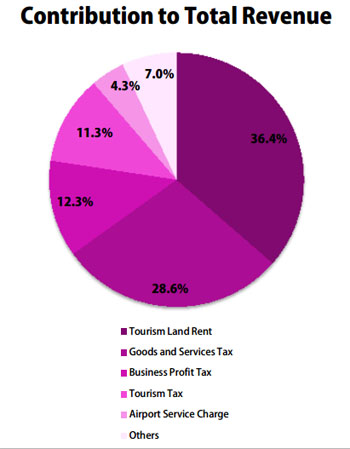

The MDP MP for Lhaviyani Hinnavaru explained that parliamentary approval would be required for the new revenue raising measures, such as reversing reduced or eliminated import duties, hiking T-GST to 15 percent, raising the airport service charge from US$18 to US$30 and introducing GST for telecom services.

Ibu claimed that the import duty revision to raise tariffs on oil “will not be passed in this Majlis,” calling on the budget review committee to scrap the estimated revenue forecast from import duties.

The MDP would not support increasing T-GST without consultation with the tourism industry, he added.

Predicting that the revenue in 2013 would reach “only MVR 11 billion at most,” Ibu warned that income would not be enough to meet recurrent expenditures on salaries and administrative costs.

Moreover, the fiscal deficit would be considerably higher than the forecast of six percent of GDP, he contended.

“The Finance Minister said the budget deficit in 2013 would be MVR 2.3 billion, that is MVR 2 billion less than the current year. This, too, is a serious deception,” he said, adding that the figure would be closer to MVR 5.9 billion (US$382.6 million) or higher than 10 percent of GDP.

Ibu also noted that while US$50 million was to be taken as foreign loans at an interest rate of 10 percent for budget support, the Finance Ministry did not include any information of the supposed lender.

“The [budget] document says we don’t yet know where the money is going to come from,” he said.

With a public debt-to-GDP ratio of 85 percent at the end of 2013, Ibu said international financial institutions would declare the Maldives “bankrupt.”

The majority leader also criticised Finance Minister Jihad for failing to mention budgeted salary increases for military and police officers as well as plans to hire 800 new officers for the security services.

Combined with the transfer of about 5,400 employees in the health sector to the civil service, Ibu explained that the wage bill would shoot up by 37 percent.

Ibu further questioned whether funds would be available to implement the proposed public sector investment programme (PSIP) of MVR 3.1 billion (US$201 million).

“I am saying that not even 25 percent of this MVR 3 billion PSIP can be implemented next year,” he said, adding that details of lenders for the proposed loans were not provided.

Ibu also protested that the only project for Hinnavaru in 2013, the sixth largest population in the country, was a youth centre worth MVR750,000 (US$48,638).

Echoing the concerns of the parliamentary group leader, MDP MP Eva Abdulla revealed that MVR 6 million (US$ 389105) was added to the budget of the Maldives National Defence Force (MNDF) following the controversial transfer of presidential power on February 7.

Since the MDP government was ousted in the wake of a police mutiny on February 7, Eva said that the police and army have hired 250 and 350 new staff respectively.

Consequently, the institutions spent more than MVR 75 million (US$4.8 million) in addition to the approved budgets for 2012, she claimed.

The proposed budget of MVR 930.9 million (US$60.3 million) for defence expenditure in 2013 was meanwhile 14 percent higher than 2012.

Eva observed that the increase in the government’s wage bill of 37 percent was approximately MVR1.7 billion (US$110 million), which was also the amount allocated for harbour construction in the 2013 budget.

These funds should instead be spent for “harbours, education, sewerage and housing,” she argued.

“I know that the coming year is an election year. But what we know from the experience of [the presidential election in] 2008 is that the election cannot be won by adding employees to the government,” she said.

Coalition partners

Meanwhile, minority leader MP Abdulla Yameen, parliamentary group leader of the Progressive Party of Maldives (PPM), said that the government’s objectives or policies could not be discerned from the proposed budget.

“These projects are very random or ad hoc. The government’s planning should be better than this,” he said.

While continuing deficit spending and accumulating high levels of public debt was a serious concern, “a good thing about this budget is that it hasn’t considered taking funds from the MMA’s [Maldives Monetary Authority’s] ways and means account, or in common language printing money, to finance this MVR 4 billion (US$259 million) [deficit].”

Financing the deficit with loans from the central bank leads to depreciation of the rufiyaa and rising inflation, Yameen said.

Securing commercial or concessional loans to plug the deficit was however “fine in itself if it can be repaid,” he added.

While President Dr Mohamed Waheed Hassan Manik has noted the high salaries paid by institutions such as the People’s Majlis as “a serious problem,” Yameen said he could not see “any kind of sign” of reducing recurrent expenditure or salaries and allowances for government employees.

In his budget speech last month, Finance Minister Jihad noted that almost half of recurrent expenditure was paying salaries and allowances.

On the proposed revenue raising measures, Yameen said PPM could not support introducing GST for telecom services.

“I believe there should be ways to raise income for the government without taking this tax. Therefore, we, our party, cannot support trying to get MVR 200 million (US$12 million) in additional income through imposing GST on telecommunications,” he said.

Concurring with the MDP parliamentary group leader, Yameen called on the government to consult the Maldives Association of Tourism Industry (MATI) to determine whether the sector would be adversely affected by the proposed T-GST hike from 8 to 15 percent.

Government-aligned Jumhooree Party (JP) Leader MP Gasim Ibrahim, business magnate and chair of the budget review committee, said that parliament should consider the economic and social impact “at the micro-level” of the proposed revenue raising measures.

Gasim urged MPs on the budget committee to assess the costs and benefits of the proposed measures, noting that increasing import duties would lead to higher prices.

The MP for Alif Dhaal Maamigili appealed against proposing “unrealistic and empty documents” with the budget and pledging infrastructure projects that could not be delivered.

“The budget we passed for this year was in reality higher than MVR 16 billion (US$1 billion). But coming to year’s end we know from the revised budget that we achieved about MVR 12 billion or MVR 13 billion. So we are actually showing a dream to the public. We are intoxicating them with hopeful fantasies,” he said.

MP Visam Ali of the government-aligned Dhivehi Rayyithunge Party (DRP) meanwhile said it was regrettable that a sizeable portion of the population did not have access to “basic services” such as sewerage, water and electricity while the GDP per capita was forecast to exceed US$5,500 in 2013.

With public debt projected to reach 82 percent of GDP next year, Visam said immediate steps were needed to avoid “bankruptcy”.

She added that it was questionable whether the proposed revenue raising measures could be approved next year as the government had yet to submit any of the amendments or bills required for its implementation.

Visam also expressed concern with administrative costs for government offices increasing by more than MVR 500 million (US$32.4 million) in 2013 compared to this year, noting that it diverts funds away from the public sector investment programme.

In a recurrent complaint of most MPs who spoke during the budget debate, Visam said the two islands in her constituency were neglected in terms of development projects in 2013.

(0)Dislikes

(0)Dislikes (0)

(0)