Currency reserves in the Maldives have “dwindled to critical levels”, according to the World Bank’s bi-annual South Asia Economic Focus report.

The report highlighted that growth in South Asian countries – including the Maldives – is still below pre-economic crisis levels.

“Much of the recent slowdown in economic growth can be attributed to stagnating investment,” the World Bank stated in its findings. “Economic recovery could falter in the absence of a stronger investment climate.”

South Asian countries are “now more vulnerable” due to widening current account balances, slowing foreign direct investment, and persistently high inflation that has “limited the ability” of central banks to counter economic downturn via monetary policies.

Rising imports, and the Maldives dependency on those imports, also leaves the country more vulnerable to commodity price increases, argued the findings.

“Countries will need to improve their business climate to attract the private sector investment needed for these new entrants to find productive jobs, thereby reducing poverty and boosting shared prosperity,” said Martin Rama, Chief Economist for the South Asia Region at the World Bank.

Improving tax revenue collection and curbing energy subsidies are required for further progress to be achieved.

Maldives Monetary Authority (MMA) statistics released in January 2013 indicated that gross state reserves have shrunk to MVR 4.9 billion (US$317.7 million).

This is essentially only enough for one month of imports.

Between November and December 2012, reserves dropped 14 percent, or MVR 849.7 million (US$55 million). In comparison with the start of 2012 – when the State reserve was MVR 5.3 billion (US$343 million) – January 2013 had seen an eight percent decline.

MMA statistics explained that the reason for the downward slide at the end of 2012 was due to depletion of state funds in local and foreign banks, according to local media.

The ballooning 2012 budget deficit alerted the International Monetary Fund (IMF), which previously expressed concern that without raising revenue and cutting expenditures, the country risked exhausting its international reserves and sparking an economic crisis.

Finance Minister Abdulla Jihad told MPs in December 2012 that additional revenue was needed to finance the fiscal deficit and rein in soaring public debt, which was projected to reach MVR 31 billion (US$2 billion) or 82 percent of GDP by the end of 2013.

The governor of the country’s central bank said back in May 2012 that the Maldives was facing its worst economic crisis in recent memory.

Fiscal responsibility

Despite parliament recently rejecting an increased airport service charge, legislation on fiscal responsibility submitted in 2011 by former President Mohamed Nasheed’s government was passed with 42 votes in favour and 10 against at a sitting of parliament on April 15.

If the bill is ratified, the government would be prohibited by law from obtaining loans after January 1, 2016, in order to finance recurrent expenditure or loan repayments.

The bill also sets limits on government spending and public debt based on the proportion of GDP, mandating the state to not allow public debt to exceed 60 percent of GDP.

Borrowing from the central bank or MMA should not exceed seven percent of the projected revenue for the year, while such loans would have to be paid back in a six-month period under additional finance conditions outlined under the recently approved legislation.

Moreover, a statement outlining the government’s mid-term fiscal policy must be submitted annually to parliament at the end of the financial year in July.

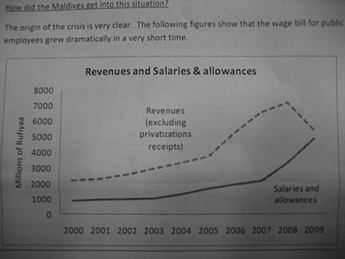

The current government has pointed the finger at the previous administration for the current budgetary issues, whilst simultaneously implementing a series of policies which have added to its financial obligations.

These deficit expanding policies have included promoting 1000 police officers, the hiring of 110 new police officers, and a reinterpretation of the legal provision for the payment of resort island lease extensions which had cost the government MVR92.4million (US$6million) already in comparison with the same point last year.

The government also chose to reintroduce MVR100 million (US$6.5 million) fishing subsidies and to reimburse MVR443.7 million (US$28.8 million) in civil servant salaries, reversing measures implemented during the previous government’s own austerity drive.

(0)Dislikes

(0)Dislikes (0)

(0)