Elections Commission (EC) members met with the government today in compliance with the Supreme Court’s order to consult relevant authorities within 72 hours of its verdict, regarding the re-scheduling fresh presidential elections by its October 20 deadline.

The Supreme Court late last night annulled the first round of the election in a 4:3 decision. Citing a secret police report on alleged electoral irregularities, the court ordered fresh elections by October 20 with enhanced police and government involvement.

After the Majlis meeting today, Independent Institutions Committee member Hamid Abdul Ghafoor described the verdict as “incomprehensible”, and as “technically and logistically not possible”.

The Supreme Court verdict was issued despite unanimous positive assessment of the polling by more than a thousand local and international election observers, while the police report on which it was supposedly based has not been made public and was not shown to the EC’s defence lawyers.

The EC was forced to postpone the presidential election’s second round, citing a lack of state cooperation that prevented the commission from holding a “free and fair vote without intimidation, aggression, undue influence or corruption” on September 28.

The announcement was made September 27, shortly before the EC secretariat was surrounded by Special Operations police with orders from Police Commissioner Abdulla Riyaz to take over the building and ballot papers should it proceed with election preparations.

Parliament

EC officials met with parliament’s Independent Institutions Committee at 12:30pm today, Maldivian Democratic Party (MDP) MP Ghafoor told Minivan News today.

Although committee meetings are normally closed to the public, with the EC’s consent the committee agreed to talk to the media openly about today’s proceedings, Ghafoor explained.

“EC officials refused to leave the Supreme Court last night until they were given a copy of the verdict, which wasn’t provided until 1:30am,” said Ghafoor.

“The Supreme Court totally changed the EC’s mandate in their verdict,” he continued. “They have created a mandate that is totally different from what the law requires.”

Ghafoor highlighted some of the inconsistencies and “constitutional contradictions” within the verdict.

“It requires one new staff member to be hired for each ballot box to conduct ‘new functions’, although it’s not clear what those functions will be,” explained Ghafoor. “That’s 470 new people that have to be hired and trained in the next 12 days.”

“Additionally, the constitution stipulates the final voter list is the EC’s responsibility, but the Supreme Court verdict requires that the commission consider the list provided by the Department of National Registration (DNR) as their primary source,” said Ghafoor.

“The problem with the DNR is that because of bad management there are various errors with their list, which is why the EC should be the final arbiter of the voter registry. The sole authority of the list is up to them according to the constitution,” he continued. “The Supreme Court verdict contradicts the constitution.”

By law it is up to the EC to decide election dates, however the constitutionally-mandated timeline “has been squashed”, noted Ghafoor. “The Supreme Court did not consult with the EC about the new timeline prior to issuing the verdict.”

In a previous meeting with the Independent Institutions Committee, the EC had said that the commission would require 19 to 21 days to conduct the election in a matter that was satisfactory and does justice to free and fair elections, Ghafoor explained.

“The more sinister aspect of this forced timeline, is that it opens up the process to corruption and vote rigging,” he highlighted.

The Supreme Court has made “a right royal mess of this”, he lamented.

The EC also told the parliamentary committee that they had requested to meet Supreme Court Chief Justice Ahmed Faiz Hussain today, as they wanted to consult all three branches of government, the executive, legislature, and judiciary, Ghafoor explained.

However, the Chief Justice instead agreed to meet the EC at his convenience tomorrow (October 9) at 9:00am.

“They are very professional in their approach, doing it by the book,” said Ghafoor. “We are very happy to have such a strong Elections Commission.”

State-funded programs to be sacrificed for elections

Meanwhile, Minister of Finance and Treasury Abdulla Jihad told local media today that the department was “legally obligated” to provide election funds, despite the lack of these available.

“We will arrange the funds even if it is from the contingency budget. But it will be an extremely difficult process. But we will provide funds for the elections. However, sacrifices will have to be made. We will have to stop some state-funded programs,” said Jihad.

He noted that the EC had not yet discussed the budget needed to re-hold the presidential election with the Finance Ministry.

In a previous interview with Minivan News, when asked what the EC would do if the Supreme Court annulled the first round results, EC Chair Fuwad Thowfeek noted: “The government has spent over MVR30 million (US$1,949,310) on the first round, there is no budget remaining [to hold both rounds again].”

“If it’s difficult for the government to provide the additional budget for the second round, there will be so many difficulties if the [results are annulled and] voting rounds are held again,” said Thowfeek.

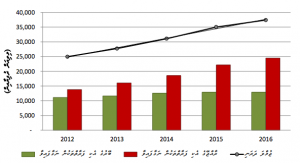

The estimated cost of the presidential election was MVR96 million (US$6,213,600) – the now-annulled first round cost MVR69 million (US$4,466,025) and MVR27 million (US$1,747,575) was allotted for the second round, according to local media.

However, re-holding the election has reportedly increased the total estimated cost to over MVR 100million (US$6,472,500).

The government is currently relying on short-term treasury bills (T-bills) to “roll over” debts on a monthly basis to address the budgetary shortfall, as recurrent expenditures for 2013 were exceeded in April.

To supplement the state budget President Dr Mohamed Waheed has been seeking to secure multi-million dollar foreign loans from financial authorities in Sri Lanka, Saudi Arabia, India and China.

President’s Office

Thowfeek and EC Vice Chair Ahmed Fayaz met with President Waheed this morning (October 8 ) in the President’s Office. Local media reported that Vice President Mohamed Waheed Deen and Attorney General Azima Shakoor also attended.

During the meeting, President Waheed called upon the EC to carry out the Supreme Court’s order to hold the presidential election’s first round in accordance with the verdict.

Waheed assured the commissioners that the government would “give all its support and cooperation” to the EC, including budgetary, security, human resources and infrastructure assistance as required.

“It is especially important that the integrity of the entire elections process is enhanced and maintained,” Waheed emphasised.

He noted that ensuring the presidential election is held in a smooth and peaceful manner is the government’s priority and that it is important “everyone puts forward national interests ahead of everything else”.

The government is meanwhile preparing to shut down for the Eid al-Adha holidays, which commence on October 11 through to October 19, a day before the Supreme Court’s election deadline.

Likes (0)Dislikes

(0)Dislikes (0)

(0)

(0)Dislikes

(0)Dislikes (0)

(0)

In September 2012, President Waheed told

In September 2012, President Waheed told  electricity and phone bills if funds were not transferred from the MVR 1.8 billion (US$117 million) Public Sector Investment Programme (PSIP).

electricity and phone bills if funds were not transferred from the MVR 1.8 billion (US$117 million) Public Sector Investment Programme (PSIP).