An internal World Bank bank report produced for the donor’s conference, called ‘Placing the Macro Challenge Facing the Maldives in Context’ has revealed the full extent of the economic challenge facing the country.

“The Maldives faces the most challenging macroeconomic situation of all democratic transitions that have occurred since 1956,” the report claims, noting that the full level of financial strife “may not be fully appreciated.”

In terms of GDP growth rate the Maldives is in the lowest 10 percent of the distribution of all transitions, and in terms of public sector deficit, the Maldives faces the worst situation of all previous democratic transitions.

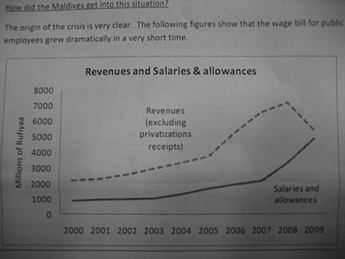

Under the heading ‘How did the Maldives get into this situation?’, the World Bank report notes that “the origin of the crisis is very clear… the wage bill for public sector employees grew dramatically in a very short time.”

An accompanying graph of the country’s total spending on ‘salaries and allowances’ shows a doubling of expenditure between 2003 and 2007, and a sharp increase between 2007 and 2009 as spending more than doubles yet again from Rf2 billion to almost Rf5 billion. Revenues meanwhile plummet steadily during 2008.

“Even before government revenues fell and when government revenues were at an all time high in 2008, the ratio of the wage bill to revenues at 46.5 percent was also at an all-time high (46.5 percent compared to an average of 38.1 percent between 2000 and 2007). When revenues plummeted in 2009, the share of the wage bill to revenues rose an astronomical 89 percent,” the report explains.

“While part of the increase was due to hiring more workers, the major part of the increase was due to the increase in compensation,” it said.

Increases to the salaries and allowances of government employees between 2006 and 2008 reached 66 percent, “by far the highest increase in compensation over a three year period to government employees of any country in the world,” the report noted.

Spokesman for the Civil Service Commission (CSC) Mohamed Fahmy said the increases needed to be considered in the context of “the total budget situation”, and were in line with government expenditure during the period.

“We have a tradition of salary increases every other year,” he said, rather than an annual increase based on inflation.

Those paid by the government included not only civil servants, “but political appointees, commissions, the judiciary”, he emphasised.

“Our case all long has been that everyone employed by the government has to be treated equally,” Fahmy said.

“If the government does not have the money to pay in full, then whatever it does have has to be paid out in an equitable manner that upholds the constitution. Everybody has to be treated equally – it is very important to make that distinction.”

World’s greatest tax haven

Meanwhile, the World Bank’s annual ‘Doing Business’ report for 2010 saw the Maldives’ ‘ease of doing business’ ranking fall from 71 to 87, and identified no ‘business-friendly’ reforms. The report acknowledges the Maldives as the world’s number one tax haven, although this could soon change if a pending bill on taxation is passed by Parliament.

Countries with successful business reforms “follow a longer-term agenda aimed at increasing the competitiveness of their firms and economy,” the report noted.

“But while successful reformers follow a clear direction in their policy agenda, they do not hesitate to respond to new economic realities,” it said. “Mauritius, the top-ranked economy in Sub-Saharan Africa, just announced a new insolvency act ‘to maintain the viability of the commercial system in the country.'”

The top countries in which to do business are Singapore, New Zealand and Hong Kong, the report noted.

Correction: An earlier version of this story described Mohamed Fahmy as a member of the ‘Civil Service Association(CSC)’. Fahmy is a member of the Civil Service Commission (CSC).