An Indian infrastructure company and a bank successfully lobbied India for sanctions on the Maldives over the 2012 cancellation of a deal to develop the international airport, the government has claimed.

The government made the allegation last month at a Singaporean arbitration tribunal, where India’s Axis Bank is seeking the repayment of a US$160 million loan from the Maldives. The loan was given to GMR group in 2011 to upgrade and manage the Maldives’ main airport.

India had tightened visa regulations for Maldivians and ceased exporting some construction materials to the Maldives, after the government took over the airport in 2012, but neither India nor the Maldives had explained the reasons for the sanctions.

India only lifted the restrictions after President Abdulla Yameen was elected in November 2013.

In its submission to the Axis Bank tribunal – obtained by Minivan News – the government claimed the bank had been involved in an “attempt to secure political pressure from the Indian government” to prevent cancellation of the deal.

The Axis Bank in 2012 also told the government it would “approach the regulatory-diplomatic authorities in India” after GMR was ordered to handover the airport, the government said.

GMR also wrote to the prime minister in August 2012 “requesting intervention by the Indian government, when it was clear that future of the concession agreement was in jeopardy,” the government said.

GMR is meanwhile claiming US$803 million from the Maldives in a separate arbitration after the tribunal ruled last year that the government had “wrongfully” terminated a “valid and binding” concession agreement.

The campaign by GMR and Axis Bank led to Indian officials including then-Prime Minister Manmohan Singh telling ex-president Dr Mohamed Waheed that the “Indian government stood ready to assist GMR in making sure [the cancellation] did not happen.”

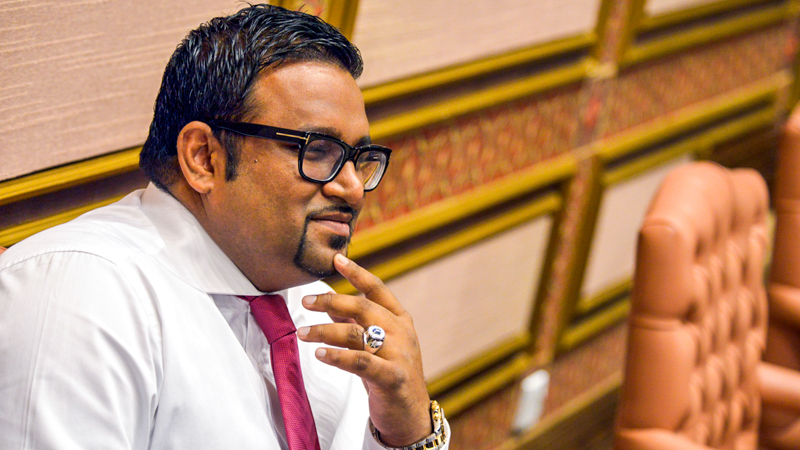

According to minister Mohamed Hussain Shareef, “the message [Waheed] got from them was confident and unbending: they expected [the Maldivian government] not to take any action to terminate the concession agreement”.

The Indian government subsequently “insisted on the repayment of outstanding debts of US$100m” in mid-November 2012 and warned of “repercussions” shortly before the agreement was terminated, lawyers representing the Maldives said.

The lawyers also alleged that then-Indian high commissioner to the Maldives “sought to intervene through several meetings with [then-defence minister Mohamed Nazim] in which he asked the Maldives to cooperate in allowing GMR/GMIAL back into the airport.”

Nazim in his testimony said that the message from India was “either back off or suffer the consequences.”

Documents disclosed during arbitration proceedings also showed that the Axis bank’s officials had met the Indian High Commissioner in January 2013, a month after the government took over the airport, lawyers added.

The submission noted that former president Mohamed Nasheed stated after a visit to India in February 2013 that “India believes the deteriorating ties between Maldives and India will recover” if the 25-year contract is restored.

“On 11 March 2013 several Indian Navy attack craft were reported as having conducted exercises just outside Maldivian territorial waters,” it added.

With the tightening of visa regulations for Maldivian citizens, dozens of people to queued outside the Indian High Commission to obtain visas to travel for medical treatment.

In February 2013, the Indian government revoked a special quota afforded to the Maldives for the import of aggregate and river sand. The move led to a shortage of the supply of construction material and rising costs for construction companies.

The current Indian Prime Minister Narendra Modi meanwhile invited the GMR chairman to a state banquet in honour of President Abdulla Yameen in January 2014, lawyers representing the Maldives noted.

Minivan News is awaiting a response to the allegations from the Axis Bank and GMR, while the government has declined to comment on the ongoing arbitration.

The Axis Bank is seeking repayment of the US$160 million loan as well as an additional US$10 million as interest and fines from the Maldivian government. The bank contends that state is liable for the loan in the event of an early termination or an expropriation of the airport.

However, the government has argued that declaring the concession agreement invalid from the outset does not amount to an early termination. The government also accused the Axis Bank and GMR of colluding to extract large sums of money, claiming the developer paid for the bank’s litigation fees for the separate arbitration process.

The Axis Bank meanwhile dismissed the argument as “highly semantic” and stated: “what words were used by the government to characterise its own acts are irrelevant to establishing whether the acts of the government amounted to an expropriation.”

Verdicts are expected in both the GMR and Axis Bank arbitrations in June.