Government spending in June rose 58 percent compared to the same period in 2013, the Maldives Monetary Authority’s (MMA) monthly economic review for July 2014 has revealed.

Total expenditure, excluding net lending, “amounted to MVR1.6 billion (US$103 million) in June 2014,” stated the report released on Sunday (August 31).

Total government revenue, excluding grants, meanwhile rose four percent in annual terms and reached MVR0.9 billion (US$58 million).

“The increase in total revenue during June 2014 was largely due to the 57 percent growth in import duty and the 9 percent increase in total goods and services tax,” the central bank explained.

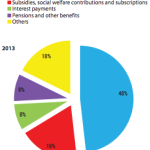

“Meanwhile, non-tax revenue registered a decline owing to the 18 percent decline in resort lease rent. As for the increase in expenditure, it was mainly due to the 30 percent increase in current expenditure.”

Budget deficit

In early August, Finance Minister Abdulla Jihad revealed that the government was facing “great difficulty in managing the budget deficit” due to shortfalls in revenue.

The ballooning budget deficit – which Jihad warned could reach MVR4 billion (US$260 million) or 10.6 percent of GDP – could affect the government’s ability to pay civil servants, he said.

A fiscal deficit of MVR1.3 million (US$84,306) had been projected in the record MVR17.96 billion (US$1.1 billion) budget approved by parliament.

The budget was inclusive of proposed revenue raising measures – many of which had failed to materialise during the previous administration – amounting to MVR3.4 billion (US$220 million), or 19 percent of the budget.

“Expenses keep on increasing, even as we don’t receive any revenue. We did not get the expected revenue this year either,” Jihad said last month.

Despite parliament passing the measures in February – including tax and import duty hikes – Jihad predicted at the time that the anticipated revenue might not be realised in full due to compromises.

“We try to make regular salary payments even if we have to take loans in order to do so,” Jihad said.

The monthly review revealed that the total outstanding stock of government securities – treasury bills and bonds – increased 18 percent in July compared to the corresponding period last year, reaching MVR13.7 billion (US$888 million).

“The annual growth in government securities was contributed by the increase in the amount of T-bills issued by the government to manage its growing cash flow requirements,” the review explained.

The MMA had previously warned that shortfalls in revenue and overruns in expenditure could jeopardise the country’s debt sustainability.

In May, MMA Governor Dr Azeema Adam called for “bold decisions” to ensure macroeconomic stability by reducing expenditure – “especially the untargeted subsidies” – and increasing revenue.

Tourism, fisheries and inflation

Tourist arrivals in July increased 20 percent from the previous month and 14 percent compared to July 2013, reaching 100,191 visitors, the review noted.

While bednights rose by nine percent in annual terms, the report noted that average duration of stay declined from 6.0 days in July last year to 5.7 days this year.

Fish purchases meanwhile declined by 44 percent to 2,124.7 metric tonnes compared to July 2013, the report revealed.

While the volume of fish exports fell by 54 percent, earnings on fish exports declined by 41 percent, which was “contributed mainly by the fall in export of frozen yellow fin tuna.”

The rate of inflation in the capital decreased to 2.4 percent from 3.5 percent in July 2013 and 3.6 percent the previous year, the review found, which was due to “the slower growth of food prices, especially fish, and the moderation in the growth in prices charged for rent and health services.”

The review noted that the trade deficit widened by 38 percent in July compared to the same period last year “due to the 27 percent increase in imports and the 34 percent decline in exports.”

Gross international reserves rose four percent from the previous month and 42 percent in annual terms, the review stated, amounting to US$497.6 million at the end of July.

“This mainly reflects the temporary increase in foreign currency transfers by the commercial banks in the review period,” the central bank explained.

“As for reserves in terms of months of imports, it also increased in both monthly and annual terms and stood at 3.2 months during the review month.”

Maumoon's biggest mistake was buttering up a huge population with civil service jobs that to this day continues to eat a huge portion of our budget while only a measly amount is left for development. It is going to be a huge task for any leader to cut those figures down coz thats gonna cost voters. On the bright side we get to enjoy a good level of transparency nowadays compared to before.

10% - heroin purchases from the Afghan Mafia.

26% - paying off local gangsters

5% - buying iphones for their snot-nosed activist brats. (those gold-plated ones are really expensive.)

9% - purchasing prostitutes for the judiciary.

8% - paying off local jihadis so they remain loyal attack dogs.

you are forgetting a new product .. Guns