Government revenue declined by MVR19.2 million (US$1.2 million) in May compared to the same period last year and reached MVR1.2 billion (US$77.8 million), the central bank has revealed in its monthly economic review.

Total expenditure during the month meanwhile rose by MVR104.9 million (US$6.8 million) and amounted to MVR1.5 billion (US$97 million).

“The decline in total revenue during May 2015 was mainly due to the decline in both tax and non-tax revenue which fell by MVR9.5 million and MVR1.7 million, respectively,” the review stated.

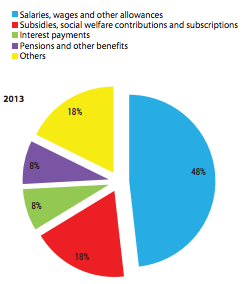

“The fall in tax revenue was mainly contributed by the decline in revenue from business profit tax and tourism tax, while non-tax revenues declined owing to a significant fall in revenue from resort lease rent. Meanwhile, the increase in expenditure was largely due to a growth in recurrent expenditure.”

In May, the government obtained US$20 million from Saudi Arabia for budget support. Finance minister Abdulla Jihad told Minivan News at the time that the funds were to be used to “manage cash flow” as revenue was lower than expected.

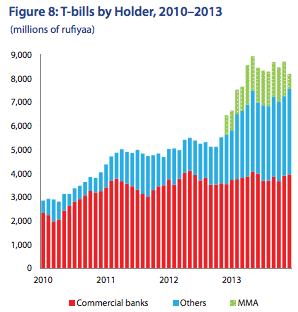

A large portion of forecast revenue is expected later in the year, he said, adding that shortfalls are currently plugged through sale of treasury bills (T-bills).

According to the Maldives Monetary Authority (MMA), the total outstanding stock of government securities, including T-bills and treasury bonds (T-bonds), reached MVR18.4 billion (US$1.1 billion) at the end of May, representing an annual increase of 36 percent.

The forecast for government income in this year’s record MVR24.3 billion (US$1.5 billion) budget is MVR21.5 billion (US$1.3 billion).

The projected revenue includes MVR3.4 billion (US$220 million) anticipated from new revenue raising measures, including revisions of import duty rates, the introduction of a “green tax”, acquisition fees from investments in special economic zones (SEZs), and leasing 10 islands for resort development.

The MMA’s monthly economic review meanwhile revealed that gross international reserves increased by 65 percent in May compared to the corresponding period in 2014 and stood at US$703.7 million, “of which usable reserves amounted to US$229.7 million.”

“During the review month usable reserves also registered increases in both monthly and annual terms by 12 percent and 41 percent, respectively. As for gross reserves in terms of months of imports, it rose both in monthly and annual terms and stood at 4.2 months at the end of May 2015.

Tourism and fisheries

The economic review noted that tourist arrivals declined by three percent in April compared to the same period in 2014, reaching a total of 102,242 guests.

“The annual decline in arrivals was contributed by the significant decline in tourist arrivals from Europe,” the MMA observed.

“In April 2015, total bednights registered a decline of 7 percent in annual terms, as the average duration of stay declined from 6.2 to 5.9 days. Partly reflecting the decrease in bednights, the occupancy rate of the industry declined to 73 percent in April 2015 from 80 percent in April 2014.”

In its quarterly economic bulletin, the central bank noted that despite a three percent growth in tourist arrivals in the first quarter of 2014, tourist bednights declined by three percent “owing to the fall in average stay of tourists from 6.3 days in Q1-2014 to 6.0 in the review quarter.”

Tourism receipts also decreased by four percent in the first quarter compared to the corresponding period in 2014.

“On the supply side, the operational capacity of the tourism industry increased by 3% when compared with Q1-2014 to reach an average of 27,827 beds. Reflecting this and the decline in tourist bednights, the occupancy rate of the industry fell to 79 percent in Q1- 2015 from 84 percent in Q1-2014,” the bulletin stated.

The volume of fish purchases meanwhile decreased to 6,134.6 metric tonnes in April, registering an annual decline of 11 percent.

“In May 2015, both the volume and earnings on fish exports declined in annual terms by 35 percent and 12 percent, respectively. This was mainly owing to the decrease in the volume and earnings of frozen skipjack and yellowfin tuna exports,” the economic review revealed.

In other sectors, the MMA noted that construction activity “continued to expand and remained robust as indicated by the annual increase in construction-related imports and increased bank credit to the sector during Q1-2015.”

“Activity in the wholesale and retail trade also grew, as indicated by increased imports by the private sector (excluding tourism) and bank credit to the sector.”

The rate of inflation in Malé meanwhile accelerated to 1.7 percent in April from 1.1 percent in March.

“The pick-up in inflation during the month was mostly contributed by the growth in fish prices and prices charged for housing rent,” the central ban explained.

“The monthly percentage change in the [Consumer Price Index] increased in April 2015. This was mainly due to the rise in fish and cigarett e prices. Cigarette prices rose during the month due to the increase in the import duty levied in April 2015.”