Finance Minister Abdulla Jihad submitted an estimated 2015 state budget of MVR24.3 billion (US$1.5 billion) for parliamentary approval today – 35 percent higher than this year’s record MVR17.96 billion (US$1.16 billion) budget.

“The estimated budget deficit for 2015 is MVR1.3 billion [US$84 million],” Jihad said in his budget speech at today’s sitting of parliament.

“This is 2.5 percent of GDP. The deficit is to be financed by MVR1.1 billion [US$71 million] estimated from foreign parties and MVR223 million [US$14 million] estimated from domestic finance.”

After expressing fears in August that the deficit for this year would spiral to MVR4 billion – or 10 percent of GDP, Jihad told MPs today that the 2014 deficit was expected to be just MVR1.6 billion (US$103 million) as a result of compromises by parliament to the government’s revenue raising measures.

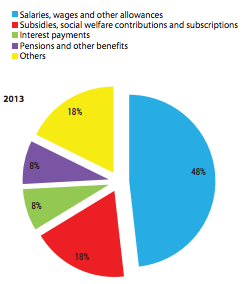

Recurrent expenditure in 2015 is expected to be MVR15.8 billion (US$1 billion) or 65 percent of the budget, he explained.

Salaries and allowances for state employees accounts for 26 percent of the total budget, Jihad noted, followed by social security and welfare (13 percent) and administrative costs (8 percent).

Capital expenditure meanwhile accounts for 30 percent of the budget, Jihad continued, which includes MVR6.3 billion (US$408 million) for the Public Sector Investment Programme (PSIP) and loan repayment.

The forecast for government income or revenue is MVR21.5 billion (US$1.3 billion), Jihad said, including MVR13 billion (US$843 million) in tax revenue, MVR6.8 billion (US$440 million) in non-tax revenue, and MVR1.7 billion (US$110 million) in free aid.

Jihad noted that MVR3.4 billion (US$220 million) is anticipated from new revenue raising measures, which includes revisions of import duty rates from July onward, the introduction of a ‘green tax’, fees from investments to special economic zones, income from the home ownership programme, and leasing 10 islands for resort development.

Fund allocations

The MVR2.9 billion (US$188 million) allocated for the education sector is 32 percent higher than 2014, Jihad continued, which includes higher expenditure on scholarships, student loans, training programmes, financial assistance for pre-schools, and the cost of implementing the new national education curriculum.

The MVR2.1 billion (US$136 million) allocated for the health sector is 21 percent higher than 2014, Jihad noted, while MVR3.2 billion (US$207 million) was allocated for social security and subsidies provided by the National Social Protection Agency, including MVR1 billion (US$65 million) earmarked for the MVR5,000 (US$324) a month pension for the elderly and MVR750 million (US$48 million) for the unlimited Aasandha health insurance programme.

Some 52 programmes would be conducted to upgrade three hospitals to tertiary level and develop infrastructure in regional hospitals and island health centres, he noted.

While MVR90 million (US$5.8 million) was allocated for fisheries and agriculture, Jihad said MVR50 million (US$3.2 million) was allocated for providing financial assistance for small and medium-sized enterprises.

“As development of Maldivian youth is one of the most important pledges of this government, MVR300 million [US$19.4 million] has been budgeted to conduct different programmes aimed at youth,” Jihad said, which was 55 percent higher than 2014.

Funds have also been earmarked for the celebration of the 50th anniversary of independence, Jihad noted.

Notable PSIP projects include the development of the Ibrahim Nasir International Airport (INIA), the Malé-Hulhulé bridge project, the Indira Gandhi Memorial Hospital (IGMH) renovation project, water and sewerage projects for 66 islands, coastal protection for 22 islands, 23 new harbour construction projects and 38 ongoing harbour projects, and waste management projects in 105 islands.

Funds have also been allocated in the budget for a renewable energy project expected to commence next year, he added.

A total of MVR695 million (US$45 million) was earmarked for housing programmes, Jihad continued, which includes the construction 1,985 housing units in Hulhumalé.

In addition to a project to resolve flooding in the capital, Jihad said 15 road construction projects in other islands were included in the budget.

2014

While the projected deficit for 2014 was MVR1.3 billion, Jihad said the deficit at the end of the year would be MVR1.6 billion (US$103 million) as a result of compromises by parliament to the government’s revenue raising measures.

A proposed Tourism Goods and Services Tax hike was delayed from July to November while the reintroduction of the US$8 bed tax was delayed by a month.

While the finance ministry anticipated payments for resort lease extension fees in full, parliament revised the budget for the fees to be paid in instalments over 18 months.

Jihad meanwhile noted that the International Monetary Fund’s (IMF) global economic outlook released in October predicted economic growth in 2014 and 2015 after the recovering from the global financial crisis and recession of 2007 to 2012.

Accordingly, domestic economic growth in 2014 was expected to be 8.5 percent, Jihad said, while the forecast for 2015 is 10.5 percent – driven by tourism, telecommunications, and transport.

The tourism industry is expected to grow by 8 percent with 1.5 million tourist arrivals, he added, while the inflation rate has meanwhile remained steady at 1.4 percent as of September.

On the balance of payments, Jihad revealed that the current account deficit would reach US$290 million or 10 percent of GDP, although it is projected to decrease to US$215 in 2015.

The official reserve at the end of 2014 is expected to be US$445 million – projected to rise to US$460 million next year.