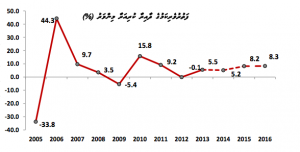

Expansion of domestic economic activity in the third quarter of 2014 was “driven by the sustained growth of the tourism sector,” according to the Maldives Monetary Authority’s (MMA) quarterly economic bulletin.

“Total tourist arrivals to the country increased to 299,491 in Q3-2014, growing by 7 percent when compared to the corresponding quarter of last year while bednights grew by 5 percent,” the bulletin stated.

The central bank explained that the “difference in the growth rate of arrivals and bednights is explained by the fall in the average duration of a tourist visit from 6.0 days to 5.8 days during the period.”

Tourism receipts are meanwhile projected to reach US$594.9 million in the third quarter, an annual growth of 20 percent.

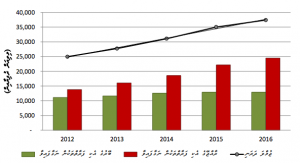

“In Q3-2014 the average operational bed capacity of the industry also increased by 4 percent when compared to Q3-2013 and rose to 26,921 beds, contributed by the opening of three resorts and thirty-three guesthouses during the period,” the bulletin revealed.

“Despite the increase in the operational bed capacity of the industry, the occupancy rate of tourism accommodation facilities remained relatively unchanged at 70 percent when compared to Q3-2013, owing to the higher increase in bednights.”

However, tourist arrivals in November declined by 5.1 percent compared to the same period last year, according to statistics from the tourism ministry.

While tourist arrivals reached 89,778 guests last month, 94,584 arrivals were recorded in November 2013, with arrivals from Europe and the Asia Pacific region down 6.8 percent and 4.6 percent, respectively.

Industry insiders had previously noted that a recent increase in T-GST alongside the continuation of Bed Tax in November had contributed to fewer bookings.

The Russian market meanwhile continued to decline due to the weakening of the Russian economy, with Russian arrivals declining by 31.3 percent to 5,273 arrivals in November from 7,675 arrivals in November 2013.

“Arrivals from the country declined at an annual rate of 7 percent in Q3-2014, compared to a decline of 5 percent in arrivals in Q2-2014,” the bulletin stated.

The number of Chinese tourists – representing the single largest market share with 27 percent – declined by 4.9 percent.

However, total tourist arrivals from January to November increased 7.9 percent from 1,020,190 guests in the corresponding period last year to 1,101,113 in 2014.

The MMA’s quarterly bulletin observed that the Chinese market was the “single major contributor to arrivals growth” in the third quarter of 2014, increasing by 8 percent compared to the previous quarter.

“Meanwhile, arrivals from Europe (which constitutes over half of total tourist arrivals) registered a marginal increase of 2 percent in Q3-2014 compared to a 6 percent growth in Q2-2014, contributed mainly by the increase in arrivals from Germany and Spain,” the bulletin noted.

“While the UK market (the largest market from Europe) posted a sluggish performance owing to weak economic conditions, the German market, being the second major source market from Europe, registered a 7 percent growth (12% growth in Q2-2014). Both Germany and UK each accounted for about one-fifth of European arrivals during Q3-2014.”

Other sectors

The central bank noted that the fisheries sector “continued to be adversely affected by falling tuna prices that deteriorated further in the international market during the review quarter.”

The volume of fish purchased from local fishermen by fish processing and exporting companies in the third quarter registered an annual decline of 24 percent, the MMA revealed.

“Additionally, the poor performance of the fisheries sector was also reflected by the fall in both the volume and earnings of fish exports in Q3-2014, by 31 percent and 21 percent, respectively,” the bulletin explained.

The construction industry “continued to strengthen, as indicated by the strong annual growth in construction-related imports and commercial bank credit to the sector.”

Reflecting a 17 percent annual increase in commercial bank credit to the wholesale and retail sector as well as a 13 percent annual growth in private sector imports, the bulletin noted that trade activity also improved in the third quarter.

The rate of inflation in the capital meanwhile decelerated from 3.1 percent in the second quarter to 2.5 percent in the third quarter, “contributed primarily by the slower growth in food prices.”

“Meanwhile, inflation excluding the volatile fish prices also decelerated during the quarter at the same rate as total inflation, explaining the relatively stable fish prices during the year as a whole,” the bulletin observed.

Overall inflation remained “steady and low” at 5.0 percent, the central bank noted.

“However, food inflation registered a much lower rate of 0.2 percent in the review quarter, compared to 3.2 percent in Q2-2014 and 7.4 percent in Q3-2013.

“A large decline in prices was noted for vegetables, particularly onions, and can be attributed to the significant decline in onion prices in India, where 89 percent of onions are imported from. The slowdown in domestic food prices also reflect the easing of global food prices, which have been declining for the most part of 2014.”

Related to this story

Tourist arrivals register 10 percent growth in first three quarters of 2014

Expansion of economic activity in first quarter driven by tourism sector growth: MMA