Resort workers staged a rally in Malé today calling on the government to set a US$600 minimum wage and to pass a trade union law to allow collective bargaining.

The Tourism Employees Association of Maldives (TEAM) organised the rally after collecting about 7,000 signatures on a petition with five main demands.

“Our campaign calling on the government and resort owners to fulfil our demands will go on, even if, in the process, resorts become unable to operate,” secretary general of the TEAM, Mauroof Zakir, told Minivan News at the rally.

TEAM has circulated the petition in more than 70 of the Maldives’ 108 resorts since April. More than half of the 11,426 Maldivians employed in the multi-billion dollar industry have signed the petition.

The other demands include a mandatory 12 percent service charge, resort shares for workers as pledged by the president, and an 80 percent quota for Maldivians in the tourism industry.

Mauroof said TEAM will present the petition next week to the president’s office, the parliament, the tourism ministry, the economic ministry, the attorney general’s office and the youth ministry.

TEAM has previously warned of strikes if the government does not heed the demands.

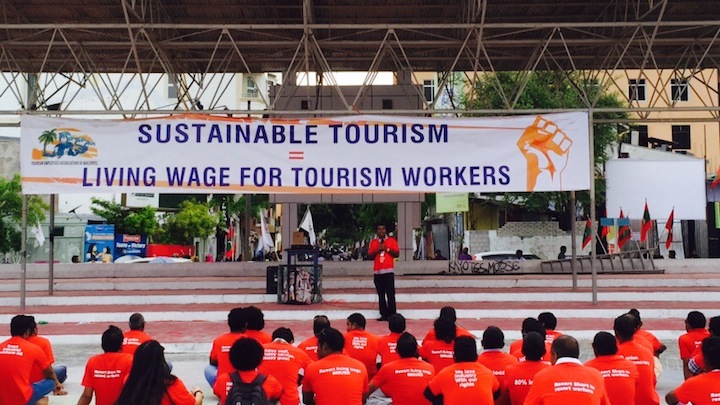

About 50 resort workers joined the rally at the artificial beach today. Mauroof said TEAM was satisfied with the turnout and had not planned for most workers to take leave at the same time.

Protesters wore red T-shirts with the demands printed on the back and draped banners that read, “Sustainable tourism = living wage for tourism workers” and “Unfair dismissal = unfair tourism.”

“Our rights are being taken away. Resort owners discriminate between Maldivians and foreigners,” a resort worker at the rally, Abdulla Jaleel Ibrahim, told Minivan News.

“[Foreign workers] get leave to go visit their families whenever they want or to bring them to the resort with a holiday package, whereas local employees have to wait up to eight months even to get a leave. We are not allowed to bring our families there either.”

Adam Hamdhy, who has been working in the tourism industry for 13 years, said resort owners did not care about local staff employed in low paying jobs.

“They don’t care about how room boys and waiters may have to live. I am truly disappointed to note that local resort employees in higher positions are working against the TEAM’s campaign and their colleagues in lower positions,” he said.

Jumhooree Party MP Ali Hussain also attended the rally and encouraged the resort workers not to give up hope or lose focus.

Hussain vowed that he would submit legislation on industrial relations if the government does not heed the demand.

Deputy tourism minister Hussain Lirar previously told Minivan News that the government will consider the petition.

“The industry consists of a lot of stakeholders, not only TEAM. We will have to hold discussion with all of them before implementing new regulations,” he said.

The Maldives does not have a policy on minimum wage and setting one will require an amendment to the Employment Act. Current laws meanwhile require 50 percent of resort employees to be local, but the rule is not widely enforced.

Preliminary figures from the 2014 census indicated that foreign employees amount to 59 percent of all tourism employees, with 16,342 expatriate workers.

According to TEAM, US$358 million is transferred out of the country as wages for migrant workers annually.

Mauroof previously said that implementing the quota would help achieve the current administration’s pledge of creating 94,000 new jobs.

Providing shares in resorts to their rank-and-file employees was a campaign pledge of President Abdulla Yameen. Most resorts in the Maldives are owned by private companies and controlled by a few wealthy individuals.

In February 2014, President Yameen said that by the end of the year, a number of resorts would be floating a portion of their shares to the public, and urged Maldivian employees to become shareholders.

Last week, tourism minister Ahmed Adeeb said the government will announce a model for offering shares to workers before the end of the year.