The tourism industry’s Gross Domestic Product (GDP) growth in 2012 declined by 0.1 percent following 15.8 percent growth in 2010 and 9.2 percent in 2011, the Finance Ministry revealed in a “Fiscal and Economic Outlook: 2012 to 2016” statement included in the 2014 budget (Dhivehi) submitted to parliament last week.

“The main reason for this was the political turmoil the country faced in February 2012 and the decline in the number of days tourists spent in the country,” the statement explained.

“The most important statistic used to measure productivity in the tourism sector is the total number of nights tourists spend in the country. As the most number of tourists to the country now come from China, we note that the low number of nights on average that a Chinese tourist spends in the Maldives has an adverse effect on the tourism sector’s GDP.”

However, despite negative growth in 2012, the tourism industry is expected to have grown by 5.5 percent in 2013, with a 5.2 percent growth rate forecast for 2014.

The Maldivian economy is largely dependent on tourism, which accounted for 28 percent of GDP on average in the past five years, and generated 38 percent of government revenue in 2012.

According to the annual tourism yearbook published by the Tourism Ministry, the average occupancy rate of all tourist establishments in 2012 was 2.5 percent below the previous year – at 70.6 percent.

“The major decline in occupancy rate was recorded from the resort/hotel sector, while the occupancy rate of guest houses and safari vessels remained constant at 23.4% in 2012,” the yearbook stated.

The average duration of stay fell from 8.6 days in 2009 to 6.7 days in 2012.

Moreover, following 20.7 percent growth in tourist arrivals in 2010 and 17.6 percent in 2011, the growth rate slowed to 2.9 percent in 2012, well below the annual average of 7.7 percent growth rate from 2008 to 2012.

“Fiscal discipline”

The outlook statement meanwhile observed that most economic and monetary problems facing the Maldives were “directly or indirectly related to the state’s ‘fiscal discipline.'”

The Finance Ministry noted that a fiscal responsibility law ratified in May stipulates that government debt must be brought below 60 percent of GDP within the next three years.

While public debt in 2012 stood at 78.6 percent of GDP in 2012, the outlook statement revealed that it had fallen to 72.6 percent this year.

However, the figure is expected to grow to 81 percent of GDP in 2014.

A budget surplus in the coming years would be necessary to reach the legally mandated target, the finance ministry stated.

While the estimated fiscal deficit in the 2013 budget was MVR1.4 billion (US$90 million) or 3.6 percent of GDP, the deficit at the end of the year would stand at MVR1.7 billion (US$110 million) or 4.7 percent of GDP, the statement noted.

The main reason for the higher than expected deficit spending was failure to implement proposed revenue raising measures intended to generate MVR1.8 billion (US$116.7 million) in new income.

The measures included hiking the Tourism Goods and Services Tax (T-GST) to 15 percent, raising the airport service charge to US$30, leasing 14 islands for resort development, raising tariffs on oil, introducing GST for telecom services, and “selectively” reversing import duty reductions.

In April, parliament rejected government-sponsored legislation to raise the departure tax on outgoing passengers, prompting Finance Minister Abdulla Jihad to seek parliamentary approval to divert MVR 650 million (US$42 million) allocated for infrastructure projects in the budget to cover recurrent expenditure.

The move followed a cabinet decision to delay implementation of new development projects financed out of the budget due to shortfalls in revenue.

Meanwhile, Jihad reportedly told parliament’s Finance Committee last week that no foreign bank was willing to lend to the Maldives anymore because of instability.

Meanwhile, Jihad reportedly told parliament’s Finance Committee last week that no foreign bank was willing to lend to the Maldives anymore because of instability.

When the new revenue did not materialise, Jihad said the finance ministry approached foreign banks to sell treasury bills, but was turned down. Some banks refused to roll-over previously sold T-bills, he added.

As a result, Jihad said, the government was forced to overdraw from the public bank account at the Maldives Monetary Authority.

Moreover, banks only agreed to buy T-bills at an 11 percent interest rate, Jihad said, which would not be sustainable for the government.

While MVR500 million (US$32 million) a month was needed to pay salaries and allowances for state employees, government income in some months was just MVR300 million (US$19 million), Jihad noted, leaving no option but to turn to the central bank.

Deficit and debt

The total public and publicly guaranteed external debt in 2012 stood at MVR11 billion (US$713 million) and was estimated to have reached MVR11.6 billion (US$752 million) this year, the outlook statement revealed.

A total of MVR2 billion (US$129 million) from foreign loans was disbursed in 2013 for development projects, with 7.44 percent from multilateral financial institutions, 34.5 percent from bilateral partners, and 51.8 percent from commercial banks.

The MVR839 million (US$54 million) estimated as budget support in 2013 meanwhile included US$25 million from a stand-by credit facility provided by India in 2011 and a US$29.4 million loan from the Bank of Ceylon.

The external public debt is projected to increase to MVR12.5 billion (US$810.6 million) next year, the finance ministry noted.

Domestic debt in 2012 was MVR13.8 billion (US$895 million) and MVR16 billion (US$1 billion) in 2013. This figure is projected to rise by 15 percent to MVR18.5 billion (US$1.19 billion) next year.

The state’s total debt in 2013 is therefore estimated to be MVR27.7 billion (US$1.79 billion) – expected to rise to MVR31 billion (US$2 billion) in 2014.

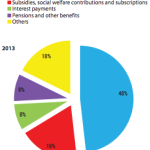

The government spent MVR2.7 billion (US$175 million) in 2012 and MVR3.5 billion (US$227 million) in 2013 for loan repayment and interest payments to service foreign and domestic debts.

"Meanwhile, Jihad reportedly told parliament’s Finance Committee last week that no foreign bank was willing to lend to the Maldives anymore because of instability."

(1) This is what we've been saying all along! Jihad has finally admitted to the fact that the illegal regime that took control on 7th February has bankrupted the country!

(2) In the modern globalised economy stability and transparency plays a huge part. Maldives is 100% dependent on imports, foreign trade and good bilateral relations. Bilateral relations have never been worse than today in the entire history of this country.

(3) There is no country willing to lend money and no bank willing to lend money either but at extortionate interest rates reflecting the state of the country. Waheed went to Saudi Arabia and begged for 300 millions US dollars; he got a big fat cheque for ZERO dollars!

(4) In short, the illegal regime has taken the country to rock bottom! Despite, ever increasing revenue, tourist numbers etc, money seem to be going down a bottomless pit! You cannot blame this on the previous regime or Gay or Nasir or Mohammed Ameen Didi! There are no political appointees of any of those currently paid out of state treasury.

As Jihad has noted, with an income of MRf 300 million a month, the state has to pay MRf 500 million in salaries! Now, tell me, do we need a calculator to work out the result?

Election rigging and coups is not good for business. We could be the next Eygpt if this continues. There tourism industry is in chaos now.

So I see the days of the crow baagee regime has dealt the worst economic blow to this country 6 years

With this bloated and ever bloating government and services without developmental growth gives one a foreboding sense of doom, imagine that recurrent expenditure has to be plugged up by borrowed money.

Maldives debt amounts to approximately $4000.00 for every man, woman and child. This amount of debt is unsustainable for such a small country.

Austerity will be redefined when instigated in the Maldives. Examine the torment on Ireland and especially Greece. The IMF will demand a new stable Government before lending money. This will not be fortcoming.

When the electricity goes off and there is no fuel to cook with or fuel the boats. When the printed money fuels inflation to unsustainable levels. When the police and army no longer receive wages and long after the tourists have all fled or cancelled...

Then.....

You will see the bodies of Gayoom and Waheed and the SC hanging from the street lamps.

A final note on this.....

The behaviour of this government rivals or probably surpasses the lunacy displayed during the reign of Idi Amin in Uganda during the 1970's

http://en.wikipedia.org/wiki/Idi_Amin

and that of Robert Mugabe currently in Zimbabwe.

http://en.wikipedia.org/wiki/Robert_Mugabe

You may be interested to know, that

"Zimbabwe's highest court has declared unconstitutional a law which makes it a crime to insult the president."

Source BBC News

Well at least the judges in Zimbabwe are not total retards.

How embarrassing for Maldivian's to be less civilised than Zimbabwe!

“The major decline in occupancy rate was recorded from the resort/hotel sector"

Looks like it is just not me who has decided to never is it the Maldives.

The arteries of the illegitimate occupational regime have been slashed open.