A total of MVR9.8 billion (US$635.5 million) has been pledged to the Maldives by 24 foreign investments registered so far, President Abdulla Yameen said in his presidential address today.

In the address delivered at the opening of the People’s Majlis’ first session of 2015, Yameen said the 24 foreign investments registered under his administration were not tourism-related.

“Under these investments, a total of MVR9.8 billion has been proposed to be invested in the Maldives during the next five years,” Yameen said over loud protests from opposition MPs calling for the release of former President Mohamed Nasheed.

The pledged foreign investments represent a 70 percent increase on the previous year, Yameen added.

President Yameen’s second presidential address was delivered amidst an ongoing political crisis sparked by the arrests and prosecution of former Defence Minister Colonel (Retired) Mohamed Nazim and former President Mohamed Nasheed on charges of terrorism.

The newly formed Maldivian Democratic Party-Jumhooree Party (MDP-JP) alliance held a massive protest march in the capital last Friday (February 27) demanding the pair’s immediate release.

During last year’s budget debate, opposition MPs expressed skepticism of the government’s forecast of US$100 million expected as acquisition fees for Special Economic Zones (SEZ) by August 2015. The opposition has also criticised the lack of significant foreign investments despite assurances by President Yameen’s administration with the passage of the SEZ Act last year.

2014

Yameen began the address by assuring MPs that the current government would protect and uphold the constitution, adding that significant efforts were made during 2014 to “strengthen the civil justice justice and criminal justice system of the Maldives”.

Legislation on civil trial procedures would be submitted to parliament this year, Yameen said.

A ‘risk management framework’ to combat drug smuggling and abuse would also implemented during 2015, he continued, and privately operated rehabilitation centres would be opened with modern facilities.

While a bill on establishing an Islamic University has been submitted to parliament, Yameen said eight new government-funded mosques would be built during the year in addition to 10 new mosques funded by Saudi Arabia.

“Seven island harbours were constructed last year. And work is underway on constructing harbours on 32 islands. Additionally, land reclamation has been completed on four islands. And while land reclamation is ongoing in three islands, coastal protection work is ongoing in three islands,” he said.

Moreover, road construction projects have been contracted for 10 islands, Yameen said.

A project awarded to the Malé Water and Sewerage Company (MWSC) to resolve flooding in the capital was nearly complete, he continued, whilst US$100 million worth of foreign loans have been secured to provide safe drinking water and establish sewerage systems in inhabited islands.

Construction of 1,089 flats in Hulhumalé have now been completed, Yameen said, and work on a further 5,000 flats would begin this year.

Reclamation of 227 hectares of land in Hulhumalé would also be completed in March, he said.

A waste management project targeting four northern atolls is meanwhile expected to be completed during the year, Yameen added.

While a fishermen’s marina was established in Felivaru last year, Yameen said three more marinas would be set up in Kooddoo, Hulhumalé, and Addu City Feydhoo.

On the education sector, Yameen said a diploma certificate has been set as the minimum qualification for teachers and a new salary structure has been put in place.

The government’s health insurance scheme ‘Aasandha’ has been expanded to cover chronic illnesses and kidney transplants, he continued, whilst a programme was launched in November to provide “super-specialist” doctor’s service to the atolls.

Legislation is currently before parliament to protect women’s rights in divorce cases, Yameen said, which would provide temporary shelter to divorced women and establish rules for equitable division of property.

Moreover, the government is formulating rules to provide easy access to healthcare and prioritise employment for persons with special needs, he said.

Loans worth MVR200 million (US$12.9 million) would be issued in the near future under the ‘Get Set’ programme for youth entrepreneurs, he continued, and a bill on youth rights would be submitted to parliament this year.

Work was underway on building 36 sports pitches in islands with populations exceeding 2,000 people, he noted.

Economy

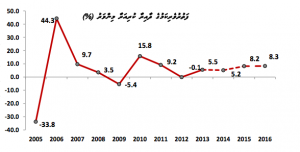

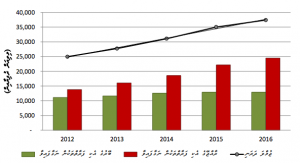

Yameen noted that the forecast for economic growth in 2015 was 10.5 percent, up from 8.5 percent last year, adding that in 2014 inflation was kept on average at 2.4 percent and the budget deficit brought down to MVR1.6 billion (US$103.7 million).

In a bid to encourage lending, Yameen said the minimum reserve requirement for banks would be reduced this year from 20 percent at present.

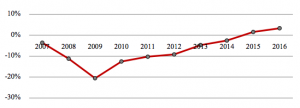

The forecast for the current account deficit in 2015 is US$214.7 million or 6 percent of GDP, he added, down from US$290 million or 10% of GDP last year.

“As a result of the increase in foreign currency the Maldives earned in 2014, serious difficulties faced by the public in obtaining dollars have been resolved, and with God’s will, the dollar shortage has been alleviated,” he said.

Referring to a decline in tourist arrivals from Russia and China in December and January, Yameen said the government has launched efforts to increase arrivals from both source markets.

“Despite the Maldives being seen as a high-end tourist destination, efforts are now underway to advertise the Maldives as an affordable luxury destination, expand the Maldivian guesthouse business, and expand the tourism industry to target mid-market [tourists] as well,” he added.

Yameen also said the government was taking back uninhabited islands leased for resort development due to contractual violations.

In the wake of former coalition partner JP’s alliance with the opposition MDP, the government seized several properties leased to JP Leader Gasim Ibrahim’s Villa Group for alleged agreement violations. Last week, the Maldives Inland Revenue Authority (MIRA) gave a 30-day notice to Villa Group to pay US$100 million allegedly owed as unpaid rent and fines.

In 2015, Yameen said 22 islands would be leased for resort development both under normal bidding processes and as joint ventures.

Yameen added that development in the SEZs would create new jobs and spur economic growth as the minimum threshold for investments was US$150 million.

The government was in the process of formulating a master plan for the ‘iHavan’ project, Yameen said, which was among the mega projects envisioned in the SEZs.

A basic design for a new terminal at the Ibrahim Nasir International Airport (INIA) has been completed, he continued, and the government was seeking interested parties to repair and resurface the airport’s runway.

Foreign policy

Yameen said the Maldives achieved significant successes during 2014. The “Maldives’ name shined in the outside world” last year, he said.

The Maldives assumed the chairs of both the Association of Small Island States (AOSIS) and World Health Organisation’s (WHO) executive board, Yameen noted.

Relationships with regional neighbours and Arab-Islamic nations were “brought back to its previous heights,” he continued.

In addition to state visits to friendly nations, Yameen said various agreements that would prove beneficial to the Maldives have been signed with India, Sri Lanka, China, and Japan.

Yameen also appealed for the participation of all Maldivian citizens in celebrating the country’s 50th independence day in July.

“God willing, this year will see new progress made in fulfilling the government’s pledges to the people,” he said.

Related to this story

Tourist arrivals decline in January as Chinese arrivals slow down

Parliament approves state budget for 2015 with 60 votes in favour

PPM celebrates SEZ bill with fireworks