The audit report of the Works Corporation Ltd (WCL) for 2011 has exposed allegedly corrupt practices at the 100 percent government-owned company.

In a press release issued with the report (Dhivehi), the Auditor General’s Office stated that its audit uncovered numerous violations of the law as well as “problems related to performance and governance.”

Since the corporation did not compile its financial statement for 2011, as mandated by its charter and the Company’s Act, the press release noted that auditors reviewed selected transactions of the WCL.

The WCL was created by the administration of former President Mohamed Nasheed on March 25, 2009 to facilitate or carry out infrastructure projects.

Of the 34 projects awarded to the company in 2010 and 2011, the audit found that the government canceled 24 after the WCL failed to commence work.

“The government awarded the projects without adequate planning and without assessing the company’s capability to carry out the work,” the press release stated.

As the company had completed only one infrastructure project to date, the Auditor General’s Office suggested that the WCL had not served the purpose for which it was formed.

Managing director

Auditors discovered that the company’s managing director withdrew MVR180,000 (US$11,673), ostensibly to cover expenses for assisting the President’s Office in preparations for a ceremony held in Gulhifalhu.

While the company’s employees actively participated in the preparations, the report noted that the sum was withdrawn without any documentation proving the actual cost borne by the WCL.

Although the audit report did not identify the managing director, local media has revealed that the WCL MD in 2011 was Abdulla Javid ‘Jaa’, son-in-law of the then-ruling Maldivian Democratic Party’s (MDP) Chairperson ‘Reeko’ Moosa Manik.

Auditors also found that MVR146,999 (US$9,533) was transferred to the MD’s personal bank account to purchase a “total station” containing special tools from Singapore’s Tepcon Posting Sales Pvt Ltd.

However, the company had received neither the tools nor the transferred amount as of the report’s publication date.

Moreover, the WCL did not recover 14 sheet piles provided in May 2011 to Heavy Load Maldives Pvt Ltd, which was owned by the MD’s father-in-law MP ‘Reeko’ Moosa.

The WCL’s staff informed auditors that the 40-feet sheet piles were released after the MD called the deputy manager at the company’s Thilafushi site and instructed him to do so.

The audit report revealed that on the orders of the MD the WCL also provided electricity from its Thilafushi site to the Yacht Tours Maldives’ site on the industrial island.

Yacht Tours Maldives – owned by MDP MP Abdulla Jabir – had not paid WCL for 37,376 units of electricity used from December 28, 2010 to October 1, 2012, the audit found.

Violations

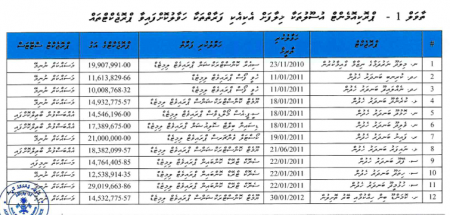

The WCL awarded 12 projects worth MVR198.6 million (US$13 million) to various parties in violation of the company’s procurement rules, the audit found.

The company’s procurement procedures manual stated that contracts worth MVR1.5 million (US$97,276) or higher must be awarded through the Finance Ministry’s tender evaluation board.

However, the audit noted, the 12 projects were awarded without either a bidding process or the involvement of the tender evaluation board.

An Indian company – identified as MM Export Pvt Ltd – contracted to supply reinforcement boulders was paid MVR2.7 million (US$175,097) in violation of the procurement rules as well as the WCL’s agreement with the company.

In another instance, a Sri Lankan company named Sri Krithika International was paid in excess of the stipulated amount for supplying construction material after the company imported a higher volume than was agreed upon.

Moreover, the WCL failed to recover MVR1.7 million (US$110,246) paid to Design-built Solutions Pvt Ltd as an advance payment for the Noonu Velidhoo harbour project despite termination of the agreement after the company did not commence work.

In a similar case, a company named Coastal Ventures Pvt Ltd was paid MVR5 million (US$324,254) for the construction of a harbour in Raa Fainu despite the company only completing a portion of the project.

As the portion completed by the company was worth MVR2.9 million (US$188,067), the audit noted that the company was paid MVR2.1 million (US$136,186) for work not done.

The report also contended that the WCL prioritised the interests of subcontractors in drafting agreements to the detriment of the company.

Auditors discovered that the company was owed MVR134,055 (US$8,694) in unpaid rentals and sale of equipment.

The WCL also misused a MVR50 million (US$3.2 million) stand-by credit facility provided by the Indian government to establish a sewerage system in Noonu Miladhoo and to construct a harbour in Noonu Kudafari.

Interest for the loan was rising as a result of the WCL failing to make regular payments, the report noted.

Meanwhile, as a result of poor record keeping, auditors were unable to ascertain the amount of money kept in the WCL safe when it was stolen in 2011.

While the company’s accounting systems showed that it was owed MVR22.5 million (US$1.5 million) from various parties, the audit report noted that the company’s financial book-keeping was too unreliable to establish the validity of the figure.

Similarly, auditors could not verify whether the MVR60.7 million (US$4 million) owed by the WCL for procurements and services was authentic.

The company also paid its chairman more than MVR600,000 (US$38,910) as a “special allowance” from June 2009 to February 2012 against the pay scheme for board members of state-owned enterprises.

Moreover, the company’s hiring and firing practices as well as promotions for staff contravened its “employment, benefits and salary policy.”

Lastly, the WCL had not maintained a registry of its assets since April 14, 2010, auditors found.