Tourist arrivals in February increased by five percent from the previous month and six percent in annual terms, according to the Maldives Monetary Authority’s (MMA) latest monthly economic review.

“The annual increase was due to the rise in the number of arrivals from Asia and Europe,” the central bank’s monthly report noted.

While total bed nights in February rose five percent compared to the same period last year, the occupancy rate rose three percent from February 2013 to 89 percent this year.

The average duration of stay however “declined marginally in annual terms during the review period,” the report stated.

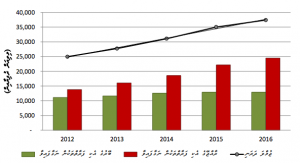

The MMA had previously revealed that tourist arrivals rose 17 percent in 2013 compared to the previous year “mainly due to the large increase in tourist arrivals from China, coupled with a slight growth in arrivals from Europe.”

Statistics from the Tourism Ministry show that 331,719 Chinese tourists visited the Maldives last year, which was a 44.5 percent increase from the previous year.

Chinese tourists accounted for 29.5 percent of all tourist arrivals in 2013.

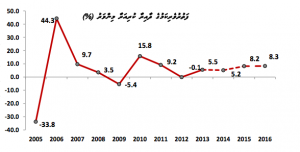

In November 2013, the Finance Ministry revealed that the tourism industry’s GDP growth in 2012 declined by 0.1 percent following 15.8 percent growth in 2010 and 9.2 percent in 2011.

Despite negative growth in 2012, the Finance Ministry estimated that the industry would have expanded 5.5 percent in 2013 and forecast a growth rate of 5.2 percent for this year.

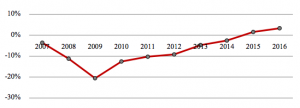

The average duration of stay has however fallen from 8.6 days in 2009 to 6.7 days in 2012, and 6.3 days in 2013.

According to the annual tourism yearbook published by the Tourism Ministry, the average occupancy rate of all tourist establishments in 2012 was 2.5 percent below the previous year at 70.6 percent.

The Maldivian economy is largely dependent on tourism, which accounted for 28 percent of GDP on average in the past five years, and generated 38 percent of government revenue in 2012.

Meanwhile, in the second largest industry, the volume of fish exports increased by nine percent in February compared to the previous year “largely contributed by the increase in the volume of fresh, chilled or frozen tuna exports.”

“However, earnings from fish exports declined by 25 percent during the same period, due to the fall in both the volume and earnings from canned or pouched tuna exports,” the review revealed.

“Additionally, earnings from yellow fin tuna exports also declined during this period compared to 2013.”

The rate of inflation – measured by the annual percentage change in the consumer price index in Malé – rose to 3.4 percent in February from 2.6 percent in January.

“This was largely due to the increase in fish prices,” the report explained.

“Similarly, the rate of inflation increased in monthly terms during February 2014, which was also due to the rise in fish prices.”

Public finance

The economic review noted that government expenditure “more than doubled” in January to MVR1.9 billion compared to the same period last year.

Total revenue fell by 11 percent to MVR1 billion “largely due to the 27 percent decline in business profit tax (BPT) [receipts].”

“Additionally, non-tax revenue also fell, owing to the significant decline in resort lease rent. As for the increase in expenditure, it was mainly due to the increase in subsidy payments,” the report stated.

As a result of “increased investments in T-bills by commercial banks, other financial corporations and public non-financial corporations,” the review noted that the total outstanding stock of government securities – treasury bills and bonds – rose nine percent in annual terms and 10 percent in monthly terms during February.

The trade deficit meanwhile narrowed by 29 percent during February compared to the previous year.

“This was due to the significant decline of 26 percent in imports which off set the 16 percent decline in exports. The decline in imports was contributed by the fall in petroleum products,” the report explained.

“Gross international reserves increased in both monthly and annual terms by 2 percent and 13 percent respectively and reached US$391.1 million at the end of February 2014. Reserves in terms of months of imports also rose in both monthly and annual terms to 2.7 months at the end of the same period.”

(0)Dislikes

(0)Dislikes (0)

(0)